Griffin Pitt, right, works with two other student researchers to test the conductivity, total dissolved solids, salinity, and temperature of water below a sand dam in Kenya.

(Image: Courtesy of Griffin Pitt)

This year, taxes are due by Tuesday, April 18—a little later than in the past.

It’s a welcomed delay for Victor Adams, who says, laughing, “I ironically always end up doing mine in April.”

Even so, tax filing season, which starts in January, is always Adams’ busiest time of the year. As supervisor of the Tax and International Operations group at Penn, he oversees all the W-2 and 1042-S processing, making sure every student, faculty, and staff member is properly coded in the University’s tax system. And as related questions arise, he makes sure they get answered.

To ensure a smooth process, the Office of the Comptroller recently rolled out its Tax Helpdesk Support Submission Form, which allows users to submit online requests that are ticketed. User-friendly menus are offered as a guide.

“Aside from making sure we’re able to efficiently answer people’s questions and fix errors, it helps us to identify reoccurring inquiries,” Adams says. “For instance, a lot of individuals asked about how to read their W-2, so we implemented a classroom training on how to do this, and also included a W-2 Breakdown on our website.”

Sent out in January, all Penn employees should have received their W-2 information in the mail, or, if they opted out of a printed form, have access to it online.

To access electronic W-2 forms, login to ADP W-2 Services at the U@Penn website. Choose My Tax Info from the My Pay section. Log-in with your PennKey and password, and enter your birthday and the last four digits of your Social Security Number. By following the remainder of the prompts, employees should be able to download their statement right to their computer.

Accessing a W-2 online is easy, Adams says, and a lot more secure. In fact, it’s the preferred method.

“Every year, we get about 2,500 W-2s sent back to us because of bad addresses,” he explains. “But if someone who’s not you decides to open it, they have your Social Security Number. It’s really best to opt out of printing your W-2 just to be on the safe side.”

All employees should have also received a 1095-C form, which is an annual statement describing available health insurance, administered by the Division of Human Resources. Like last year, filers will need to indicate on their tax returns if they had qualifying health coverage in 2016. Although the Internal Revenue Service does not require details from the 1095-C, it is important to keep this information for your records.

If a person is considered a nonresident alien for U.S. tax purposes and has received payments from Penn for a fellowship/scholarship, independent contracted services, or royalties, or have a benefit under a tax treaty with his or her resident country, he or she should have received a 1042-S form. International students should have also received an email from International Student and Scholar Services (ISSS) with information on filing taxes in the U.S., as well as information on tax software that is being made available—the Windstar Foreign National Tax Resource—designed specifically for foreign nationals. If an international student has not yet received this tax information, he or she should email ISSS.

Adams notes that Penn employees are not authorized to provide personal tax advice, though his door is always open if there are issues concerning the forms he oversees. He says he always suggests that “individuals seek out a tax accountant or expert, especially if your taxes are complex.”

Lauren Hertzler

Griffin Pitt, right, works with two other student researchers to test the conductivity, total dissolved solids, salinity, and temperature of water below a sand dam in Kenya.

(Image: Courtesy of Griffin Pitt)

Image: Andriy Onufriyenko via Getty Images

nocred

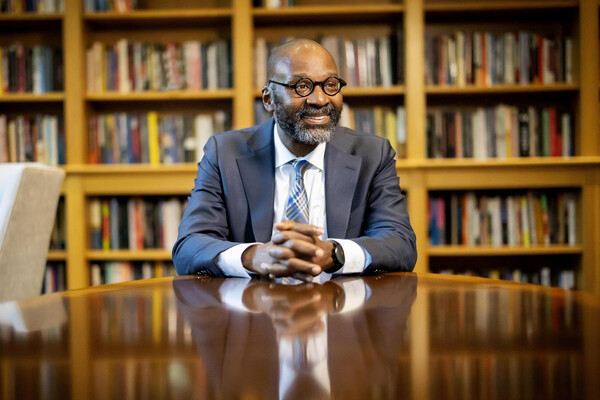

Provost John L. Jackson Jr.

nocred