Image: Kindamorphic via Getty Images

The COVID-19 pandemic has made a substantial impact on retail and, as a result, brands are continuing to strategize on how best to engage with customers as many shift to online spending. The “Wharton Baker WisePlum Consumer Loyalty Study,” released in early August, finds that consumers are less forgiving, needing more from retailers despite the global pandemic, putting consumer loyalty at risk.

Thomas S. Robertson, the Joshua J. Harris Professor and professor of marketing at the Wharton School, explores the topic in the paper, “Many Unhappy Returns: The Changing Nature of Retail Product Returns and Future Research Directions.”

“We are seeing brands looking for ways to improve customer experience, however our research shows there is still a lot of friction in the experience and the pandemic has made this worse,” Robertson says. “Customers are experiencing more issues with their online shopping experience, proving that not all retailers are suitably prepared for this digital shift.”

The study, according to Robertson, also found that while loyalty reward program benefits can protect retailers from damage that result from friction, they can also exacerbate customer problems and increase harm to the retailer brand—“a true boomerang effect.”

“The global pandemic has intensified issues for consumers and calls for retailers to carefully explore their offerings while staying focused on the fundamentals of customer experience,” Robertson says.

The study, developed by Wharton’s Baker Retailing Center and WisePlum—a Verde Group company—was initially commissioned in February 2020 and surveyed more than 5,000 customers. But as the world entered a global pandemic, a second wave of research was conducted in May with an additional 2,500 customers to identify changes to the retail customer experience. Consumers were asked about their most recent retail purchase experience (excluding grocery, liquor, and prescription drug purchases).

WisePlum CEO Paula Courtney says in the second study, researchers noticed that while customers generally experience similar issues, the economic damage associated with friction was higher, and customers were significantly less loyal to retailers in a time when retailers are themselves struggling to survive.

“Consumers have spoken and they’re looking for more from their retailers, proving to be less forgiving compared to pre-COVID-19,” Courtney says. “As we continue to monitor consumer loyalty, we’re carefully watching the shift to online shopping across multiple retail verticals and consumer segments, and tracking the performance of the retail sector to meet the demands of this digital consumer.”

Robertson says return policies are critical to building brand reputation and customer loyalty, but they have to be carefully crafted so they don’t become burdensome to the company.

“It’s a conundrum as both an opportunity and a curse,” he says.

• Overall loyalty decreased during the pandemic.

• The more problems customers have, the less loyal they are to a retail brand—66% of customers reported at least one problem on their last shopping trip, up from 60% reported in the initial pre-COVID study conducted in March 2020.

• Consumers significantly increased their online shopping during the pandemic by 37%, four out of the top five problems experienced relate to issues with the online shopping experience, opening up more issues for consumers and in turn, damaging retailer’s brands.

• Consumers who had problems were 35% less loyal than those who were problem-free.

• The appeal of loyalty program benefits stayed mostly the same pre- and mid-pandemic.

• Customers expect many of the same “must-haves” from their retailers.

• 47% of customers report being part of the retailer’s loyalty program, with loyalty program members experiencing more problems due to higher engagement and frequency than non-members.

• Customers who attempted to return an item experienced a problem 69% of the time.

• 85% of Gen Z shoppers had at least one problem during their last purchase and had a significantly higher number of problems—11.5 problems—during their last purchase.

• Customers are aggrieved by stock availability and inventory problems, with “no in-store availability” at the top of the list.

Robertson says the research of retail has “become an industry issue,” and “it’s ripe for further research.”

He adds there are still a lot of questions when it comes to the customer/retailer relationship and they will shift as the pandemic changes.

Dee Patel

Image: Kindamorphic via Getty Images

nocred

nocred

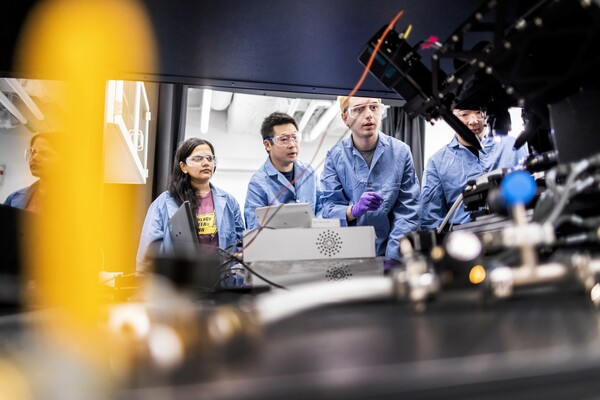

(From left) Kevin B. Mahoney, chief executive officer of the University of Pennsylvania Health System; Penn President J. Larry Jameson; Jonathan A. Epstein, dean of the Perelman School of Medicine (PSOM); and E. Michael Ostap, senior vice dean and chief scientific officer at PSOM, at the ribbon cutting at 3600 Civic Center Boulevard.

nocred